Best Credit Cards for Your Needs

Introduction

When selecting a credit card, it's essential to find one that matches your lifestyle and financial goals. Credit cards offer various benefits, from rewards to cash back, that can provide value. Understanding the features of the best credit cards can help you make an informed decision.

Advertisement

Types of Credit Cards

Credit cards come in many types, such as reward cards, balance transfer cards, and travel cards. Each type offers distinct benefits tailored to different spending habits. It's crucial to identify which type suits your financial needs best, ensuring you maximize the card's benefits.

Advertisement

Rewards and Cashback Cards

Rewards credit cards are popular for their points or cashback on purchases. Typically, rewards are earned based on spending in categories like groceries, dining, or travel. Cashback cards, on the other hand, offer a percentage of your purchases back, often ranging from 1% to 5%.

Advertisement

Travel Credit Cards

Travel credit cards provide benefits like airline miles, hotel points, and travel insurance perks. They are ideal for frequent travelers wanting to reduce travel expenses while earning rewards. Many offer bonus points for travel-related purchases, making them appealing for those on the go.

Advertisement

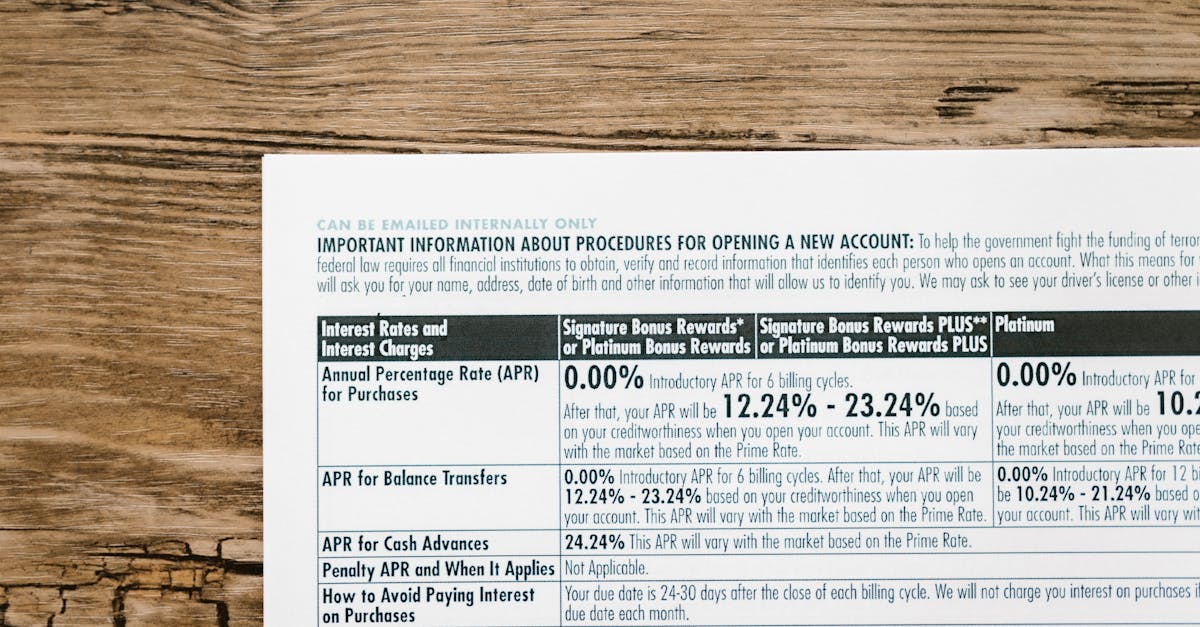

Low-Interest and Balance Transfer Cards

Low-interest credit cards are designed for those who may occasionally carry over a monthly balance. These cards often come with a lower APR, making it less costly to pay off over time. Balance transfer cards facilitate moving existing debt to a card with a lower interest rate, saving money on interest payments.

Advertisement

Student and Secured Credit Cards

For those new to credit, like students, secured credit cards offer a practical way to build a credit history. These require a security deposit, which becomes the credit line, minimizing lender risk. Over time, responsible use can lead to an improved credit rating, opening doors to better financial opportunities.

Advertisement

Fees and Penalties

Credit cards may include fees such as annual fees, late payment fees, and foreign transaction fees. When choosing a card, consider these costs to determine the true value it offers. Some cards waive annual fees for the first year, and others provide no foreign transaction fees, advantageous for international spenders.

Advertisement

Comparing Interest Rates

Interest rates significantly impact the cost of borrowing. It's essential to compare APRs when selecting a credit card, especially for those planning to carry a balance. Competitive rates make a significant difference over time, reducing the financial burden of carried balances.

Advertisement

Choosing the Right Card for You

Choosing the best credit card depends on evaluating your financial habits and goals. Consider factors like rewards offered, interest rates, fees, and purchase behaviors. By assessing these elements, you can select a card that offers maximum benefits aligned with your spending habits.

Advertisement

Conclusion

Selecting the best credit card involves understanding your financial needs and preferences. Whether you prioritize rewards, travel perks, or low fees, a suitable card awaits. Make informed choices and enjoy the benefits and flexibility that a well-chosen credit card provides.

Advertisement